Hiring a Cleaner in Switzerland Legally in 2026

Most people do not mind paying for support at home. What they mind is the admin.

In Switzerland, the moment you pay someone for household work, you become a private employer under social insurance rules. Even a few hours per month can trigger legal obligations.

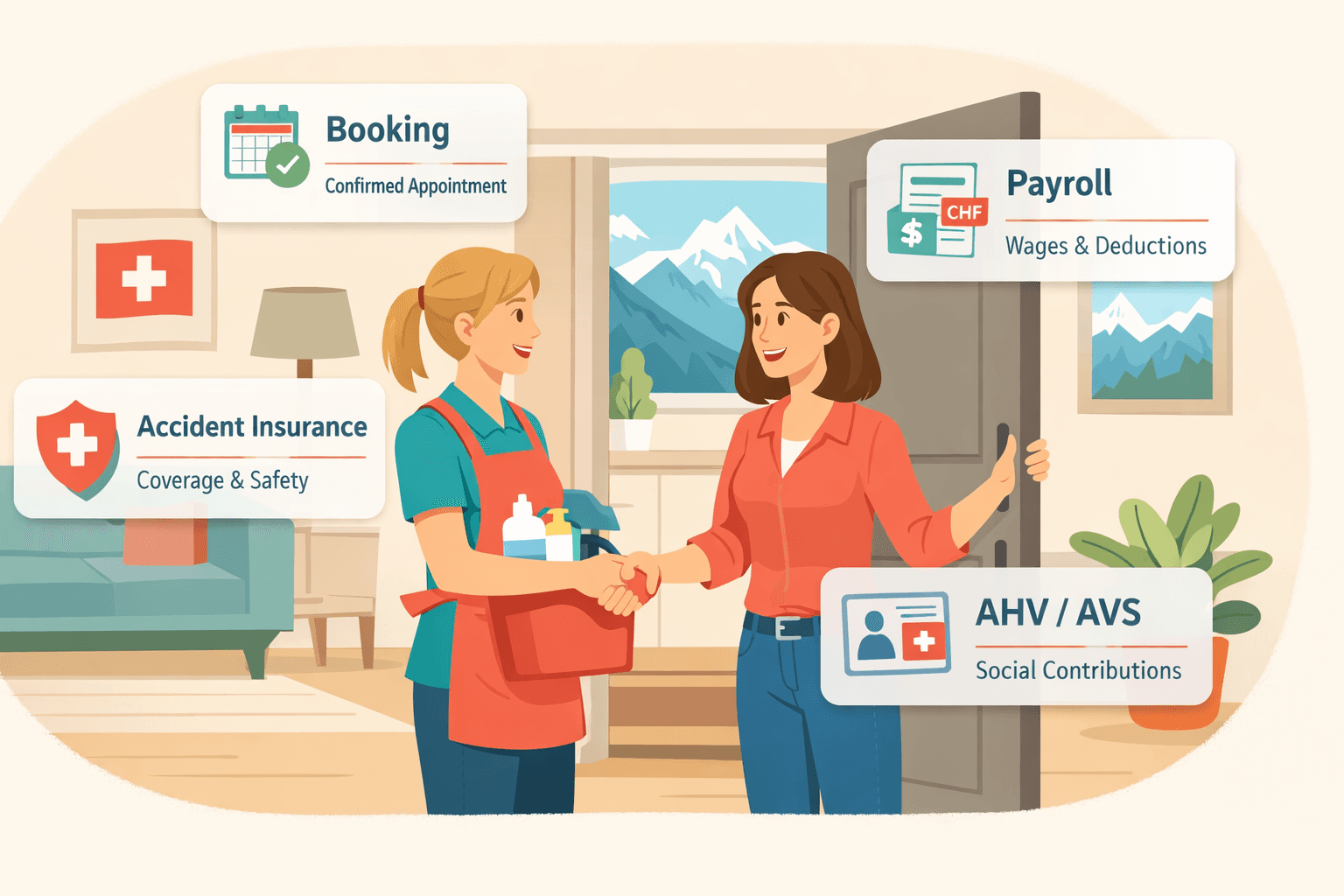

Helpore is built for exactly this. You book a trusted helper, and the admin stays structured.

Under Helpore's model, the client remains the legal employer, while Helpore handles administrative execution on the client's behalf (social contributions, accident insurance, and withholding tax where required) through a limited power of attorney. See the legal framework in our Terms & Conditions.

How do I hire a cleaner legally in Switzerland?

In practice, legal setup usually means six essentials:

- Agree the scope, pay, access, and cancellation rules in writing.

- Register and pay social contributions (AHV/AVS and related items).

- Take out compulsory accident insurance (UVG/LAA).

- Run payroll correctly: gross wage, holiday supplement for hourly work, deductions, and records.

- Handle withholding tax if the helper is subject to source taxation.

- Keep clean records for wages, contributions, and insurance.

If you want the "handled" route, you can create a client account and book a helper.

Do I need to register my cleaner with AHV/AVS?

In most cases, yes.

For domestic work in private households, AHV/AVS guidance is clear: contributions are generally due even when annual pay is below CHF 2,500.

For 2026, the AHV leaflet lists age-based exceptions:

- Born in 2000 or earlier: contributions are generally due.

- Born between 2001 and 2008: contributions are due in 2026 if annual pay exceeds CHF 750. Below that threshold, contributions are exempt unless requested by the employee.

- Born in 2009 or later: no contributions are due and no notification to the compensation office is required.

Important: failing to register domestic staff can lead to criminal consequences.

What counts as domestic work?

AHV guidance for domestic work includes more than just cleaning. Typical examples include:

- Cleaning

- Childcare and babysitting

- Au pair work

- Home support and homework support

- Elder support

- Paid work in or around a private home (for example gardening)

If paid work happens in a private household, treat it as domestic work unless you have clear legal confirmation otherwise.

Do I need accident insurance for a helper?

Yes. Domestic staff in private households must be insured against accidents.

The key UVG split is hours per week with the same employer:

- Under 8 hours/week: occupational accident cover is mandatory.

- 8 hours/week or more: occupational and non-occupational accident cover are both mandatory.

Premium logic also matters:

- Occupational accident premiums are paid by the employer.

- Non-occupational premiums are paid by the employee (usually paid to the insurer by the employer, then deducted from wages).

What is the minimum wage for domestic work in 2026?

For many roles, the federal NAV Hauswirtschaft baseline applies from 1 January 2026 (gross wage, excluding holiday and paid public holiday supplements):

- Unskilled: CHF 20.35/hour

- Unskilled with at least 4 years of professional domestic work experience: CHF 22.30/hour

- Trained with EFZ: CHF 24.55/hour

- Trained with EBA: CHF 22.30/hour

Two practical points:

- Holiday pay is separate for hourly setups.

- Cantonal rules can impose higher floors.

Do I need to pay holiday pay for hourly cleaning work?

Yes.

Domestic staff are entitled to paid holidays. For hourly wages, holiday pay is paid as a visible supplement.

Common rates used in Swiss domestic payroll:

- 8.33% for 4 holiday weeks

- 10.64% for 5 holiday weeks

- 13.04% for 6 holiday weeks

Do not hide holiday pay inside one unclear all-in hourly number.

What social contributions apply in 2026?

At a high level, the employer pays contributions to the compensation office and deducts the employee share from gross wage.

The AHV domestic work leaflet lists these core 2026 rates:

- AHV/IV/EO: 5.3% employer + 5.3% employee

- ALV (up to CHF 148,200 salary): 1.1% employer + 1.1% employee

- Family compensation fund and administration costs: fund-specific / canton-specific

This is why informal cash workflows break down quickly: you need correct gross wage, deductions, and reporting.

When is BVG pension mandatory?

BVG is not automatic for every household helper.

According to the AHV leaflet, BVG becomes compulsory when one of these thresholds is met:

- Monthly salary over CHF 1,890 (temporary contract of at least 3 months), or

- Annual salary over CHF 22,680

Do I need to deduct withholding tax?

Sometimes.

It depends on residence status, permit type, and canton rules. If withholding tax applies, the employer is responsible for deduction and remittance.

If you use Helpore, the platform can process withholding tax obligations on your behalf where applicable, under the limited power of attorney described in our Terms & Conditions.

Real cost example: 3 hours per week at CHF 30/hour

Example assumptions:

- Hours per month: 3 x 52 / 12 = about 13

- Base gross wage: 13 x CHF 30 = CHF 390

- Holiday pay (4 weeks): 8.33% x CHF 390 = about CHF 32.50

- Gross incl. holiday pay: CHF 422.50

- Core employer-side AHV+ALV (6.4%): CHF 27.04

Subtotal before accident insurance and fund-specific items: about CHF 449.54 per month.

Legal setup usually means predictable add-ons, not chaos.

Can I still pay cash?

You can physically pay in cash. The legal question is whether the employment is declared and compliant.

If domestic work is not registered, you can face penalties and back payments. If accident insurance is missing, exposure is even higher.

For a deeper risk breakdown, read: Cash-in-Hand vs. Compliant Work: The Real Risks & Costs.

What should I agree before the first appointment?

Before the first session, align in writing on:

- Tasks: bathrooms, kitchen, floors, dusting, laundry, ironing, oven, fridge, windows

- Supplies: who provides products and what must not be used

- Access: keys, alarm, building rules, parking, doorbell

- House rules: pets, shoes, smoking, sensitive items, off-limit rooms

- Quality expectation for first visits

- Cancellation notice and illness handling

Clear setup prevents most disputes.

Why clients and helpers use Helpore

Helpore reduces the "I need to become HR" burden:

- Structured booking and payment flow

- Administrative handling of statutory items

- Clear records for clients and helpers

- Support when something needs attention

Start here:

FAQ

Can I hire a helper for only a few hours per month?

Yes. Domestic-work rules still apply even for small jobs.

What details do I need for registration?

Identity details and AHV/AVS number. The AHV leaflet notes this can be taken from the OASI/DI insurance card or health insurance card.

Do I need a written contract?

An oral contract can be binding, but a short written agreement is the practical standard.

If someone says they are self-employed, am I off the hook?

Not automatically. Ask for official confirmation of self-employed status for that specific activity.

Where do I confirm canton-specific rules?

Check your cantonal compensation office and tax office. Rules for withholding tax and certain fund rates are canton-dependent.

Official Sources

- AHV/AVS domestic work leaflet 2.06 (2026): ahv-iv.ch/p/2.06.e

- Federal Office of Public Health on compulsory accident insurance: bag.admin.ch/en/accident-insurance-who-is-subject-to-compulsory-insurance

- Federal standard employment contracts (NAV) overview: seco.admin.ch/.../Normalarbeitsvertraege_Bund.html

- Federal Council communication on NAV Hauswirtschaft extension and wage update (effective 1 January 2026): admin.ch media release